Marc Faber is a contrarian. To be a good contrarian, you need to know what you are contrary about. It helps to be a worldclass economist-historian, to have been a trader and Managing Director of Drexel Burnham Lambert when the firm was the junk bond king of Wall Street, to have lived in Hong Kong for a quarter of a century, and to have a contact book crammed with the home numbers of many of the movers and shakers in the financial world.

Famous for his contrarian approach to investing, Marc Faber does not run with the bulls or bait the bears but steers his own course through the maelstrom of international finance markets. In 1987 he warned his clients to cash out before Black Monday in Wall Street; he made them handsome profits by forecasting the burst in the Japanese Bubble in 1990; he correctly predicted the collapse in US gaming stocks in 1993; and he foresaw the AsiaPacific financial crisis of 1997/98 and the resulting global volatility.

Nury Vittachi writes in "Riding the Millennial Storm": Faber has style. A ski racer in his youth, he remains a flamboyant character. He plays to the press, who call him Dr Doom; his monthy newsletter, always an excellent read, is called 'The Gloom, Boom and Doom Report'. He wears a ponytail, in defiance of the expectation (in Asia, especially) that investment managers should look conventional. His book, The Great Money Illusion, written in a hurry after the 1987 crash, was dedicated "to many beautiful and kind women whose names are better kept confidential".

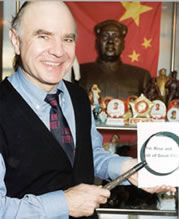

His office is eclectic. Nineteenthcentury oil paintings of Hong Kong and Macau, mingle with Korean paintings, an amazing collection of Mao memorabilia (including one white alabaster statue with a red scarf tied round its neck), an ancient horned gramophone with old Chinese records, soft flufly yellow toys and a china polar bear, bottles of XO brandy and cases of Grolsch beer. He has a superb library of first editions of works on economics and stockmarket cycles in a variety of European languages, being a multilingual Swiss and a collection of a quarter of a million Mao badges. What he says is usually impeccably well argued, but it is the delivery which makes him so sought after as a speaker: he is a master of rhetoric, and of vivid everyday examples, and the very dry sense of humour and the heavy Swiss accent provide an irresistible mix. (He describes his own writing as 'SwissGerman pidgin English, but is actually one of the most articulate and grammatical people I know.)

It is amazing how much vitriol the mention of Faber's name can generate mainly from traders with a limited sense of historical perspective. He is well aware of this reaction. Back in 1987, he wrote: 'No one likes a party spoiler, and as long as the stockmarket orgy goes on the pessimists are shunned almost as badly as AIDS carriers.' The more intelligent professionals around town give him considerably more respect even when they don't understand the detail of his operations. Some assume that he says one thing and invests differently. Other people assume he is a simplistic and publicityseeking contrarian. A large number think of him as 'Dr Doom', the congenital pessimist. He plays up this image, or is at least amused by it and lets it run.

Ready to get started?